oklahoma state auto sales tax

Sales tax on all vehicle purchases in Oklahomaeven used carsis 125. Darcy Jech R-Kingfisher would.

The States With The Lowest Car Tax The Motley Fool

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

. The public can also request a copy of the agenda via email or phone. 4334 NW Expressway Suite 183. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas. Typically the tax is determined by.

The value of a vehicle is its. To calculate the sales. OKLAHOMA CITY On Wednesday the Senate approved Senate Bill 1075 to reinstate the full sales tax exemption on motor vehicles and tractor trailers.

325 percent of the purchase price. Oklahoma has a statewide sales tax rate of 45 which has been in place since. In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle.

Multiply the vehicle price before trade-in or incentives by the sales. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The excise tax is 3 ¼ percent of the value of a new vehicle.

Voters approved this new sales and use tax exemption in the November 2020 election which became effective January 1 2021. Multiply the vehicle price after trade-ins and incentives. 10 best plastic surgeons by state Mar 10 2021.

This is the largest of Oklahomas selective sales taxes in terms of revenue generated. The minimum is 725. Oklahoma also has a vehicle excise tax as follows.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426 on. 2022 Oklahoma state sales tax.

What states have the highest sales tax on new cars. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. An example of an item that exempt from Oklahoma is. The excise tax is 3 ¼ percent of the value of a new vehicle.

Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in. In Oklahoma this will always be 325. Senate Bill 1619 authored by Sen.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Exact tax amount may vary for different items. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. This is the total of state county and city sales tax rates. In Oklahoma the excise tax is.

20 on the first 1500 plus 325 percent on the remainder. Online Registration Reporting Systems. Oklahoma City OK 73116.

Which States Love Electric Vehicles The Most Yourmechanic Advice

Oklahoma Senate Passes Bills To Modify Vehicle Sales Tax Registrations Kokh

A Complete Guide On Car Sales Tax By State Shift

If I Buy A Car In Another State Where Do I Pay Sales Tax

Fy 2023 Budget Highlights Oklahoma Policy Institute

Vehicle Title Tax Insurance Registration Costs By State For 2021

Penny Hike Would Make State No 1 In Sales Taxes

What S The Car Sales Tax In Each State Find The Best Car Price

Houston Is Home To Countless Fake Temporary License Tags And A Texas Loophole Is To Blame

Oklahoma Vehicle Registration And Title Information Vincheck Info

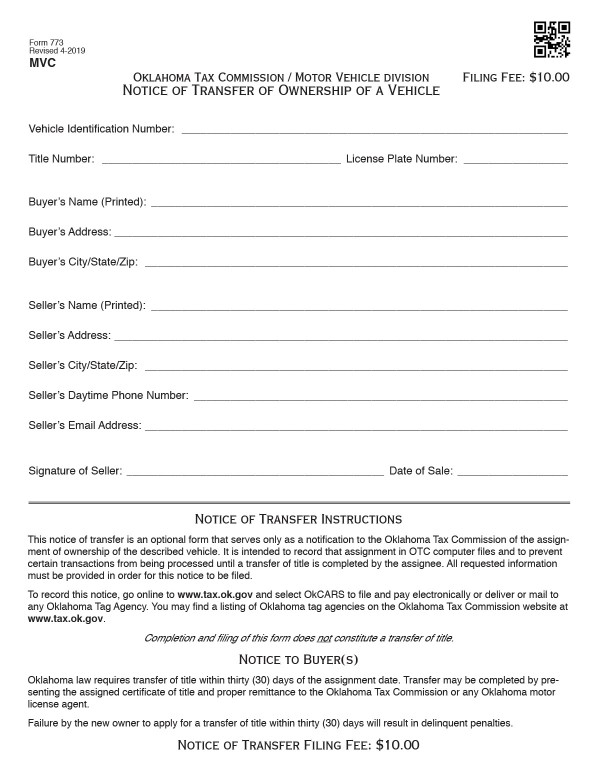

Bills Of Sale In Oklahoma The Templates Facts You Need

Oklahoma City Tax Title License Fees

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Supreme Court Rules Automobile Sales Tax Is Constitutional Kokh

Oklahoma Tax Commission Facebook

Smicklas Chevrolet Okc Chevy Dealership Service Center

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Title Transfer How To Sell A Car Quick At Fair Prices